puerto rico tax incentive act

Now known as Chapter 3 of the Incentives Code Puerto Ricos Act 20 was originally known as the Export Services Act. The 20-year tax government decree renewable for an additional ten year period allows 100 property tax exemption for the first five years of operation for certain export.

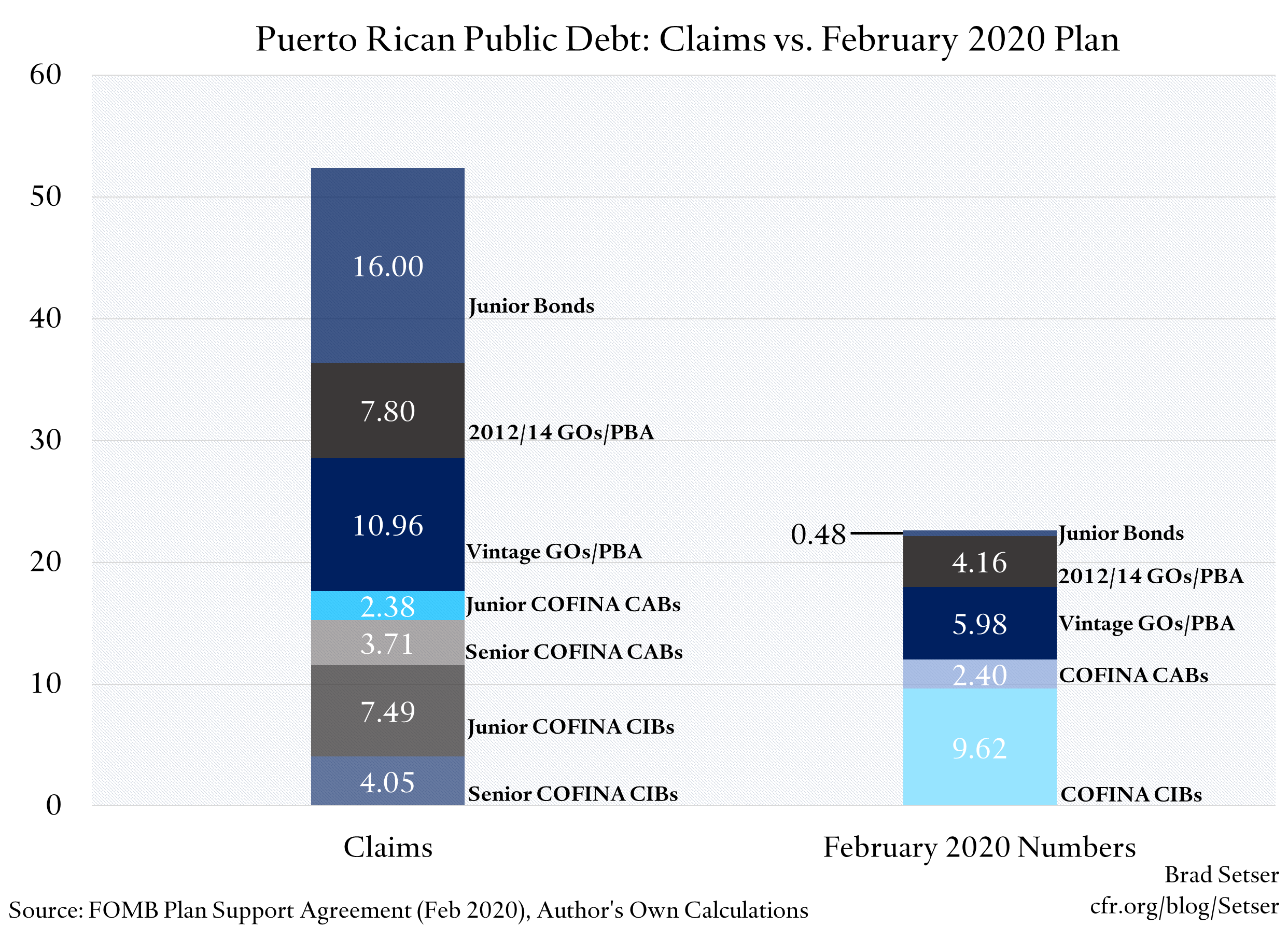

What Exactly Is In The New Agreement Between Puerto Rico S Board And Its Creditors Council On Foreign Relations

It systematizes dozens of incentive acts Acts 20 and 22 are just the most famous ones that Puerto Rico has enacted over the years.

. Act 22 - The Individual Investors Act now included under Act 60 of PR Tax Incentive Code of July 2019 Act 22 as amended also known as The Individual Investors Act was approved by the Legislative Assembly of Puerto Rico during 2012. The Act codifies incentives granted for diverse purposes throughout decades with the aim to foster economic development more effectively. In late June 2019 Puerto Rico completed a massive overhaul of their tax incentives enacting the Incentives Code.

Add a new Section 7 to Act No. To be eligible investors must donate 10000 to nonprofit entities in Puerto Rico. The Act adopts a legal and administrative framework for the application.

San Juan PR 00907. 22 of 2012 as amended known as the Individual Investors Act the Act. A collaborative multimedia investigation revealed in October 2020 that Euro Pacific Bank a Puerto Rico registered entity is under investigation for an alleged link to an international money laundering ring.

1 Fixed Income Tax Rate for pioneer or novel product manufacture. The banks senior partners Peter Schiff and Mark Anderson are Act 22 grantees since 2017. Puerto Rico Tax Incentives.

One of the most well-known Puerto Rican tax incentives the Individual Resident Investor tax incentive is available to any person who was not a resident of Puerto Rico for the 10 tax years preceding July 1 2019 and who becomes a resident before December 1 2035. 100 tax exemption from Puerto Rico income taxes on all short-term and long-term. 100 tax exemption from Puerto Rico income taxes on all interest.

The legislation allows Puerto Rico to offer qualifying businesses that export services from the island nation the opportunity to cut their corporate tax rate to a mere 4. It offers the following main tax benefits. Act 73-2008 The Economic Incentives Act for the Development of Puerto Rico is intended to help the manufacturing industry in Puerto Rico to become more profitable.

The new law does NOT eliminate the existing incentives. Act 60 includes incentives to attract new residents to Puerto Rico by providing a total exemption from Puerto Rico income. Puerto Ricos tax incentive Act 14 is titled the Return and Retention of Doctors in Puerto Rico and was established on February 21 2017.

Fixed income tax rate on eligible income. Further Chapter 2 of the Incentives Act offers tax incentives to individuals who relocate to Puerto Rico. The tax incentives enjoyed by Individual Resident Investors.

If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investors. In Puerto Rico are perhaps the most impressive of all Puerto Rican tax incentives. The purpose of this Act is to provide incentives to individuals who have not been residents of Puerto Rico to become.

Tax reductions on passive income and capital gains. 100 Sales and use tax. Act 20 Puerto Rico Tax Incentives.

Not only backed by a tax incentive program Puerto Rico also offers a highly specialized workforce and the benefits of being under the United States jurisdiction. Individual Investors Act Puerto Rico Tax Incentives. It means that under Puerto Rico Incentives Code 60 if an individual is granted Puerto Rico tax exemption under the act long term gains as a result of investments made after becoming a resident will be exempt from tax in Puerto Rico.

The Act may have profound implications for the continued economic recovery of Puerto Rico. In January of 2012 Puerto Rico passed legislation making it a tax haven for US. Posted on June 16 2021 by admin.

12 Fixed Income Tax Rate on Intangible Property. Act 60 Puerto Rico of July 1 2019 known as the Tax Incentives Code of Puerto Rico Incentives Code offers the tax incentives formerly granted under Act 22 of 2012 to individual investors that relocate to Puerto Rico. The Puerto Rico Incentives Code Act 60 helps build a vibrant community by promoting economic growth through investment innovation and job creation.

Form 8898 requires the taxpayer to provide information concerning compliance with the above requirements. The Act provides tax exemptions to eligible individuals residing in Puerto Rico. On July 1 2019 the Governor of Puerto Rico converted House Bill 1635 into Act 60-2019 known as the Incentives Code of Puerto Rico the Act.

4 Fixed income tax rate on development preproduction production and post-production income. Amend Section 8 of Act No. Puerto Ricos Act 22 tax incentives offers one of the most effective tax savings mechanisms on passive income earned from investments and capital gains making it attractive.

100 Tax Exemption on Income Tax Rate from dividends or profit distributions. 100 Tax exemption on Excise Tax. 213-2000 as amended known as the Housing Units for the Elderly and Persons with.

In a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business. 165-1996 as amended known as the Rental Housing Program for Low Income Elderly Persons. 100 tax exemption from Puerto Rico income taxes on all dividends.

This is the time to invest in puerto rico. Of particular interest are Chapter 2 of Act 60 for Resident Individual Investors and Chapter 3 for Export Services which shield new residents who live in Puerto Rico for at least half the year from paying. Puerto Rico sourced income is income from work performed in Puerto Rico.

The tax laws known as Act 20 the Export Services Act and Act 22 the Individual Investors Act shields new residents residing in Puerto Rico for at least half of the. Citizens that become residents of Puerto Rico. On January 17 2012 Puerto Rico enacted Act No.

0 Federal Income Tax. Puerto Rico Agricultural Tax Incentives Act. 4 Fixed Income Tax Rate on Income related to export of services or goods.

Learn More LEARN MORE ABOUT THE BENEFITS OF ACT 60 AND ITS INCENTIVE PROGRAMS Contact. The taxpayer moving to Puerto Rico is required to file Form 8898 with the IRS and file Form 1040 for the year of move. This tax decree is for all qualified doctors with Puerto Rico source income.

And if it the income is sourced in Puerto Rico it would escape tax in the US. On July 1 2019 Puerto Rico enacted legislation providing tax incentives for US. Make Puerto Rico Your New Home.

Citizens that become residents of Puerto Rico. Puerto Ricos Tax Incentive Act 14. 100 Tax exemption on dividend distributions.

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

Supreme Court Seems Divided Over Puerto Rico S Exclusion From Federal Benefits

Do Puerto Ricans Pay U S Taxes H R Block

A Tax Haven Called Puerto Rico Eyes On The Ties

Us Tax Filing And Advantages For Americans Living In Puerto Rico

Puerto Rico Tax Haven Is Alluring But Are There Tax Risks

Centro De Periodismo Investigativo Puerto Rico Act 22 Tax Incentive Fails Centro De Periodismo Investigativo

Immigrate To Puerto Rico And Apply For Tax Residency Act 20 Act 22 Residencies Io

Puerto Rico 39 S Act 20 And Act 22 Key Tax Benefits Insights Dla Piper Global Law Firm Law Firm Puerto Rico Insight

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Ieefa Puerto Rico S Governor Cancels Unaffordable Electrical System Debt Restructuring Agreement Ieefa

Puerto Rican Debt Crisis Action Center On Race And The Economy

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Centro De Periodismo Investigativo Acts 20 And 22 Created A Class Of Intermediaries Who Manage Tax Exemptions Centro De Periodismo Investigativo

New Puerto Rico Tax Incentives Code Act 60 Explained 20 22

Puerto Rico S Aggressive Tax Incentives Talented Local Crews Varied Backdrops Solid Infrastructure And Sound Legal Protections Puerto Puerto Rico Incentive

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

Mayaguez Puerto Rico Architectural Gem Of The West Mayaguez Puerto Rico Puerto